What are Medicare Supplements?

Medicare Supplement plans, also known as Medigap, are policies that help pay for the excess charges left over by Medicare. These costs are things like your deductibles and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement plans, or Medigap, are insurance policies sold by private insurance companies that are licensed to sell Medicare plans. They help you pay for out-of-pocket costs for services covered under Medicare Part A and Part B. These costs include deductibles, coinsurance, copayments, hospital costs after Medicare pays its share, skilled nursing facility costs, and more. Some Medicare Supplement insurance plans even include coverage for medical services while traveling outside the United States.

What are the Different Plans?

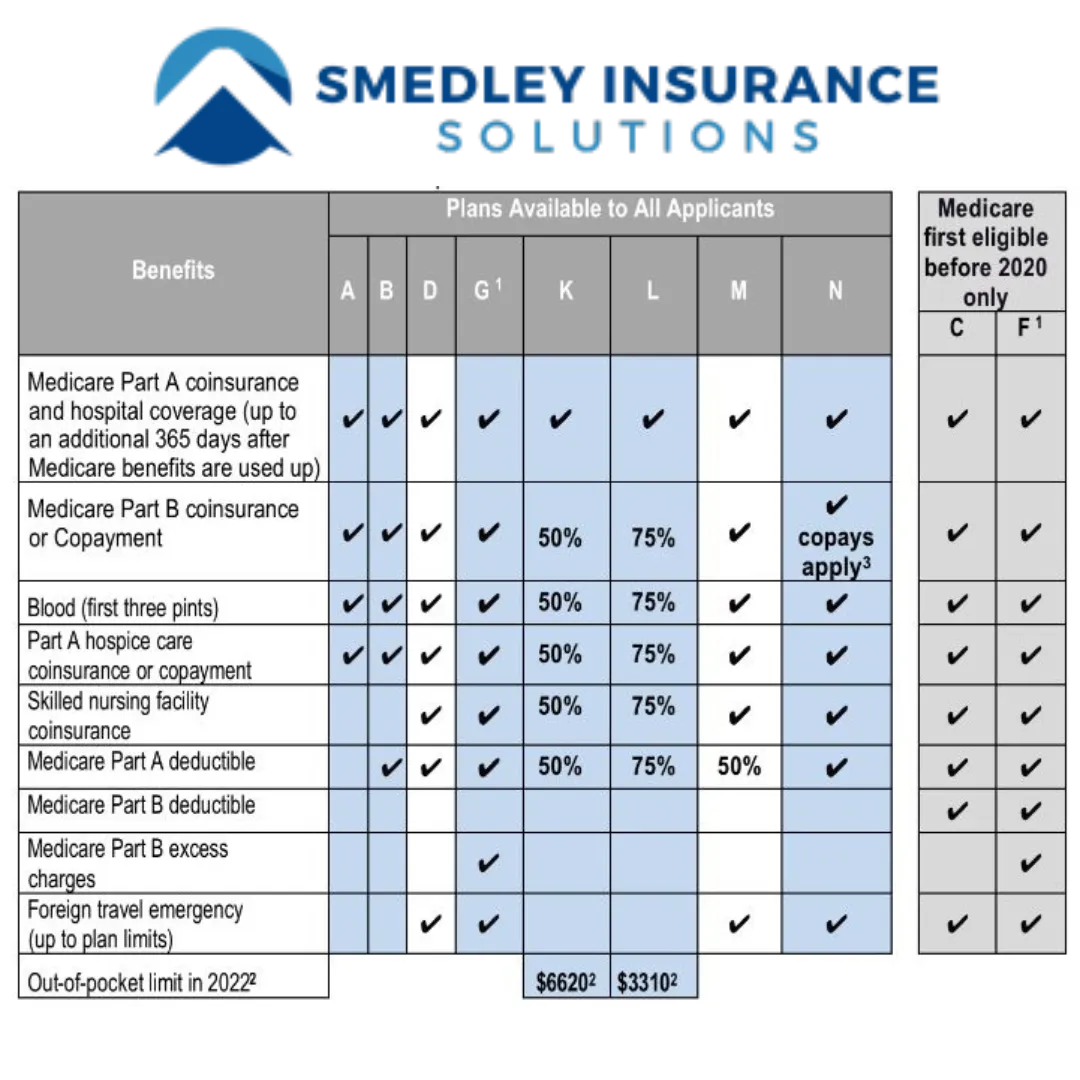

Different Medicare Supplement plans are labeled with a different letter between A through N.

Medicare Supplements feature different benefits. However, each plan must have the same standardized coverage no matter which insurance company you purchase the plan from.

Some Medicare beneficiaries want a plan that covers everything so they don’t have to worry about out-of-pocket expenses. Others simply want some of their deductibles and copays paid for but are mostly worried about low premiums. Ultimately, the choice is up to you.

Which Medicare Supplements Have the Highest Coverage?

Medicare Supplemental Plan F has the highest level of coverage. It pays for all of your cost-sharing on covered services so you have no out-of-pocket expenses.

Medicare Supplemental Plan G is the second-best in terms of coverage. The only thing not covered is that you still pay the Part B deductible once per year. This keeps your Medigap premium lower and, in turn, may save some beneficiaries some money in the long run.

Five Things to Know About Medicare Supplement Plans

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

- You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Don't Risk Getting the Wrong Coverage

Work with Smedley Insurance Solutions!

We understand the Medicare enrollment process can be difficult to understand. This is why we strive to educate and empower our clients to make the best decisions for their health insurance coverage.

Greater Sacramento Area serving Placer, El Dorado, Nevada, Sacramento, Butte and Yuba Counties.

Phone: (916) 425-5604